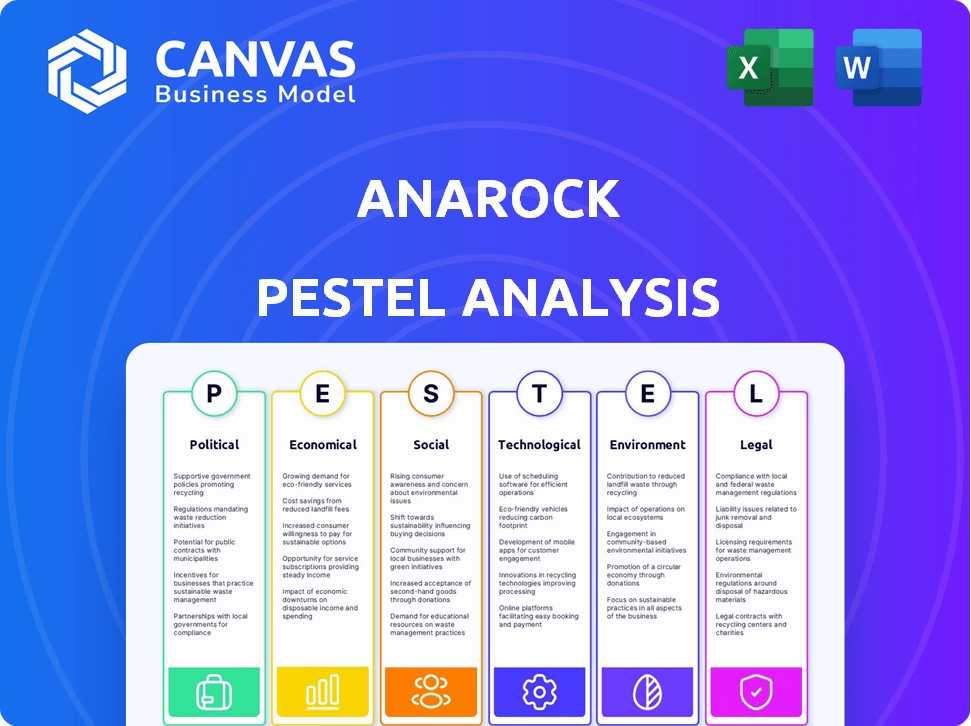

In the dynamic landscape of real estate consulting, ANAROCK stands at the forefront, navigating a myriad of factors that influence the industry. This PESTLE analysis explores the intricate web of political, economic, sociological, technological, legal, and environmental forces shaping the company's operations and strategies. From government policies impacting investment confidence to the rise of sustainable living, delve deeper to uncover how these elements interplay and drive ANAROCK's mission in the market.

PESTLE Analysis: Political factors

Regulatory policies impacting real estate transactions

The Indian real estate sector is governed by several regulatory bodies and frameworks. The Real Estate (Regulation and Development) Act, 2016 (RERA) aims to protect homebuyers and promote transparency. As per RERA, builders are required to register projects and adhere to deadlines, ensuring timely delivery. Non-compliance can lead to penalties of up to 10% of the project cost.

| Aspect | Details |

|---|---|

| Compliance Cost | Estimates suggest that complying with RERA can increase project costs by 10-15%. |

| Punitive Measures | Penalties for non-compliance can reach up to 10% of total project value. |

Government stability affecting investment confidence

Stability in government has a direct impact on investment confidence in the real estate sector. India's ranking in the World Bank's Ease of Doing Business Index was 63rd out of 190 countries in 2020. Political stability has led to a rise in Foreign Direct Investment (FDI), which peaked at USD 58 billion in the fiscal year 2020-21.

| Year | FDI Inflow (USD Billion) |

|---|---|

| 2018-19 | USD 44.36 |

| 2019-20 | USD 49.97 |

| 2020-21 | USD 58.00 |

Tax incentives for developers and real estate investors

The Indian government offers various tax incentives to stimulate investment in real estate. Developers can avail benefits under Section 80-IB(10) for affordable housing projects, with deductions of up to 100% for 5 consecutive years if constructed within prescribed limits. The GST rates applicable to residential properties were reduced to 1% for affordable housing and 5% for other residential properties as of 2021.

| Incentive | Details |

|---|---|

| GST on Affordable Housing | 1% |

| GST on Other Residential Properties | 5% |

| Section 80-IB(10) Tax Deduction | 100% for 5 years |

Zoning laws influencing property development

Zoning laws dictate land use and significantly affect property development. The urban planning framework in major cities follows the Development Control Regulations (DCR). Recent amendments have aimed to enable higher Floor Space Index (FSI). For instance, in Mumbai, FSI was increased to 4.0 in certain areas, aiming to address housing shortages.

| City | Current FSI |

|---|---|

| Mumbai | 4.0 |

| Bengaluru | 3.0 |

| Delhi | 2.75 |

Political initiatives for affordable housing

The Pradhan Mantri Awas Yojana (PMAY) is a flagship initiative launched by the Government of India aimed at providing affordable housing. Under this program, over 12 million houses have been sanctioned since its inception in 2015. The government has allocated approximately INR 1.5 trillion under PMAY to enhance housing availability in urban areas.

| Year | Houses Sanctioned (Million) | Budget Allocated (INR Trillion) |

|---|---|---|

| 2015 | 0.18 | 0.48 |

| 2016 | 0.50 | 0.36 |

| 2020 | 6.20 | 0.50 |

| Total | 12 | 1.5 |

[cbm_pestel_top]

PESTLE Analysis: Economic factors

Economic growth driving real estate demand

The Indian economy is projected to grow at an annual rate of approximately 6.1% in 2023, according to the International Monetary Fund (IMF). This growth significantly impacts real estate demand, as higher disposable incomes drive residential and commercial property purchases. For example, the National Housing Bank reported that home loan disbursements increased by 15% in 2022, indicating a robust surge in demand in the real estate sector.

Interest rates affecting mortgage affordability

The Reserve Bank of India's repo rate stood at 6.5% as of October 2023. This rate influences borrowing costs and, subsequently, mortgage rates that affect affordability for buyers. According to a report by Knight Frank, the average home loan interest rate is approximately 8.5%. A 50 basis point increase could lead to a decrease in home affordability for new buyers by approximately 5%, based on a median home price of INR 7 million.

Inflation impacting construction costs and property prices

As of September 2023, the inflation rate in India was around 6.2%. Rising inflation has been a significant factor influencing construction costs, which saw a year-over-year increase of 8% across major cities. As construction costs escalate, property prices also rise—housing prices in India increased by approximately 7.5% in 2023 compared to the previous year.

| Year | Average Construction Cost Increase (%) | Inflation Rate (%) | Property Price Growth (%) |

|---|---|---|---|

| 2020 | 3.5 | 6.3 | 2.8 |

| 2021 | 4.2 | 5.5 | 3.1 |

| 2022 | 6.0 | 6.1 | 5.5 |

| 2023 | 8.0 | 6.2 | 7.5 |

Currency fluctuations in international real estate investments

The exchange rate of the Indian Rupee against the US Dollar as of October 2023 is approximately INR 83.5. Currency fluctuations significantly impact international investments, as a weaker rupee makes properties in India cheaper for foreign investors. In 2023, foreign direct investment (FDI) in the real estate sector was pegged at around USD 5 billion, highlighting the importance of currency dynamics in driving international capital flows into the Indian market.

Employment rates influencing buyer purchasing power

India's unemployment rate was reported at 7.8% in 2023, showing a gradual recovery from previous highs. As employment rates improve, purchasing power among potential buyers increases, impacting the real estate market positively. According to the Ministry of Labour and Employment, the average monthly earnings in India have risen by approximately 12% in the last year, further supporting increased investment in real estate.

PESTLE Analysis: Social factors

Population growth increasing housing demand

As of 2023, India's population is approximately 1.4 billion people, indicating a growth rate of around 0.99% annually. This substantial increase contributes to a heightened demand for housing, evidenced by the projected requirement of about 30 million housing units by 2030 according to the Ministry of Housing and Urban Affairs. The urban population is expected to rise from 34% in 2020 to about 40% by 2030, amplifying the need for residential spaces.

Urbanization trends driving real estate development in cities

India's urbanization rate is projected to reach 50% by 2050, with major metropolitan areas like Mumbai, Delhi, and Bangalore witnessing significant population influx. This growth is expected to drive investment in urban infrastructure, increasing the real estate market’s value, which is estimated to reach USD 1 trillion by 2030, contributing approximately 13% to the country’s GDP.

Changing demographics influencing property types in demand

The demographic shift shows a rise in nuclear families and a growing youth population, with around 65% of the population under the age of 35. Consequently, demand for affordable housing and smaller units has surged, with developers reporting an increase of approximately 35% in sales for 1BHK and 2BHK apartments in urban settings over the past two years. Additionally, luxury real estate is thriving as the number of high-net-worth individuals (HNWIs) in India reached approximately 450,000 in 2022, driving demand for premium properties.

Consumer preferences shifting towards sustainable living spaces

According to a recent survey by ANAROCK in 2022, about 72% of homebuyers in India expressed a preference for properties that incorporate sustainable practices, such as energy-efficient systems and green building certifications. The green building market in India is projected to grow at a CAGR of 20% from 2023 to 2028, indicating a robust trend towards eco-friendly living.

Impact of remote work on residential property demand

The COVID-19 pandemic accelerated the trend of remote work, with approximately 50% of the workforce in urban centers adopting flexible work arrangements. This change has shifted residential property demand towards suburban and semi-urban areas, where sales increased by up to 25% in 2021 for properties outside major urban locales. In 2022, approximately 40% of buyers indicated a preference for larger homes with dedicated office spaces, further influencing market dynamics.

| Factor | Statistic | Source |

|---|---|---|

| Population Growth Rate | 0.99% annually | Government of India |

| Projected Housing Units Needed by 2030 | 30 million | Ministry of Housing and Urban Affairs |

| Urban Population Growth by 2030 | 40% | UN World Urbanization Prospects |

| Estimated Real Estate Market Value by 2030 | USD 1 trillion | Narendra Modi Government Initiatives |

| Percentage of Buyers Preferring Sustainable Properties | 72% | ANAROCK Survey 2022 |

| Growth Rate of Green Building Market | CAGR of 20% | Indian Green Building Council |

| Increase in Suburban Property Sales Due to Remote Work | 25% | Real Estate Developers Association |

PESTLE Analysis: Technological factors

Advancements in property technology transforming transactions

In recent years, software solutions such as PropTech have significantly streamlined the real estate transaction process. The global PropTech market is expected to reach USD 86 billion by 2027, growing at a CAGR of 14.3% from 2020. These advancements include platforms that facilitate online transactions, reducing paper usage and expediting processes.

Use of data analytics for market research and predictions

Data analytics to inform investment decisions has gained momentum. A report by Deloitte indicates that 83% of real estate firms are investing in data analytics platforms to enhance market research. These analytics assist in identifying trends and predicting market shifts, with companies utilizing data from 5 major sources: historical data, current market data, economic indicators, customer feedback, and competitor analysis.

Virtual reality for property viewings enhancing customer experience

The use of virtual reality (VR) in property viewings has grown significantly. According to a report by IBISWorld, the virtual reality market in real estate is anticipated to reach USD 2.6 billion by 2025. Virtual tours provide prospective buyers with immersive experiences, leading to a documented 30% increase in customer engagement compared to traditional viewings.

Blockchain technology improving transaction security

Blockchain technology is transforming real estate transactions by enhancing security. The global blockchain in real estate market is expected to reach USD 1.4 billion by 2026, growing at a CAGR of 65.4%. This technology ensures that all transactions are transparent and secure, reducing fraud by as much as 80% in the sector.

Smart home technologies increasing property value

Smart home technologies are having a profound impact on property values. In 2022, homes featuring smart technology sold for an average of USD 24,000 more than comparable homes without such enhancements. Key smart technologies include intelligent security systems, smart thermostats, and energy-efficient appliances, all contributing to a 15% increase in customer preferences.

| Technology | Market Growth / Value | Impact on Real Estate |

|---|---|---|

| PropTech | USD 86 billion by 2027 | Streamlined transactions |

| Data Analytics | Investment by 83% of firms | Enhanced market research |

| Virtual Reality | USD 2.6 billion by 2025 | Increased customer engagement by 30% |

| Blockchain | USD 1.4 billion by 2026 | Reduced fraud by 80% |

| Smart Home Technologies | USD 24,000 increase in home value | 15% increase in customer preferences |

PESTLE Analysis: Legal factors

Compliance with property laws and regulations

ANAROCK must adhere to various property laws, including the Real Estate (Regulation and Development) Act, 2016 (RERA) in India, which mandates compliance from real estate developers and consultants. According to RERA, builders must register their projects with the respective state regulatory authority, and as of October 2023, over 43,000 projects have been registered under RERA.

Litigation risks in property transactions

Litigation risks in property transactions can significantly impact ANAROCK's operations. The National Judicial Data Grid reported that as of 2023, there are approximately 3 million pending civil cases in Indian courts, with a notable portion related to real estate disputes. The average time for resolution is over 2.5 years.

Intellectual property issues related to real estate marketing

ANAROCK faces potential intellectual property issues when it comes to marketing materials and brand identity. According to a 2021 report from the World Intellectual Property Organization (WIPO), there was a 34% increase in trademark filings in the real estate sector, highlighting the competitive nature of brand protection.

Impact of land acquisition laws on development projects

The Land Acquisition Act, 2013 has significant implications for ANAROCK and its clients. As of 2023, the Ministry of Rural Development reported that about 80% of land acquisition cases involve disputes and lengthy negotiations, which can delay construction projects by an average of 2 to 4 years.

Consumer protection laws affecting buyer-seller transactions

Consumer protection is paramount in buyer-seller transactions, influenced by the Consumer Protection Act, 2019. In 2021-22, the Ministry of Consumer Affairs logged approximately 1.7 million consumer complaints, with real estate disputes accounting for 15%.

| Legal Factor | Statistics | Impact on ANAROCK |

|---|---|---|

| Compliance with RERA | 43,000 registered projects | Increased necessity for compliance and operational transparency |

| Pending civil cases | 3 million cases | Heightened litigation risk in transactions |

| Trademark filings | 34% increase | Increased focus on brand protection |

| Land acquisition disputes | 80% involve disputes | Projected delays of 2-4 years on projects |

| Consumer complaints | 1.7 million complaints (15% real estate) | Need for robust customer service and dispute resolution |

PESTLE Analysis: Environmental factors

Sustainability practices in real estate development

The real estate sector is increasingly adopting sustainability practices. For instance, as of 2021, LEED (Leadership in Energy and Environmental Design) certified buildings in India accounted for approximately 5% of the total building stock with around 1,300 certified projects, covering over 500 million square feet.

Many developers are committing to sustainable practices by 2030, targeting 100% certified green buildings for new developments. Notably, HDFC Realty has outlined plans to achieve this by implementing energy-efficient systems that reduce operational energy consumption by 30-40%.

Climate change influencing property valuation and insurance

According to the Global Climate Risk Index 2021, India ranks 7th among countries affected by climate-related weather events. In real estate, properties located in vulnerable areas are seeing a devaluation of up to 20% as a result of climate change risks, significantly affecting investment decisions.

Insurance premiums for properties in high-risk areas can increase by 15-25%, distorting market rates and influencing property transactions.

Regulations on energy efficiency in buildings

The Bureau of Energy Efficiency (BEE) has initiated the Energy Conservation Building Code (ECBC), which aims to enhance energy efficiency in commercial buildings by about 40% by 2030. Compliance with this code can lead to savings of approximately Rs. 5,000 crores annually in energy costs.

As of 2023, more than 1,000 buildings are compliant with these regulations, indicating a growing trend towards energy-efficient designs.

Environmental impact assessments required for new projects

The Ministry of Environment, Forest and Climate Change mandates that Environmental Impact Assessments (EIA) are conducted for over 40 types of projects, including large real estate developments. The EIA process typically takes 6-18 months, impacting project timelines and costs significantly.

Approximately 70% of new projects submitted for EIA approval have received feedback to enhance their sustainability measures, highlighting the importance placed on environmental considerations in real estate development.

Trends towards green buildings and eco-friendly materials

The green building materials market in India is projected to reach USD 78 billion by 2030, driven by a shift towards sustainable construction practices. Eco-friendly materials such as bamboo, recycled steel, and fly ash bricks have seen a usage increase of 50% from 2018 to 2022.

| Material Type | Percentage Increased Usage | Estimated Market Value (USD) |

|---|---|---|

| Bamboo | 45% | 1.5 billion |

| Recycled Steel | 50% | 3 billion |

| Fly Ash Bricks | 65% | 2 billion |

In the intricate landscape of real estate, a comprehensive PESTLE analysis reveals the multifaceted challenges and opportunities confronted by ANAROCK. By navigating the complexities of political uncertainties, adapting to economic fluctuations, understanding dynamic sociological shifts, embracing cutting-edge technological advancements, complying with legal frameworks, and prioritizing environmental sustainability, ANAROCK positions itself as a pioneering consultancy ready to drive impactful change in the industry. The synergy of these factors not only influences property transactions but also shapes the future of real estate in profound ways.

[cbm_pestel_bottom]

![The Jungle Book (Limited Issue) [DVD] The Jungle Book (Limited Issue) [DVD]](https://www.funeden.shop/image/the_jungle_book_limited_issue__dvd__nn8z0uuo_285x.webp)